Last updated on: 22-Dec–2024

Table of contents:

Link to the latest IB API documentation

[Q] Limitations on quantity of symbols?

[Q] Where can I find the API version info?

[Q] I’m about to post a question to IB API list. What should I do?

[Q] Is IB real time data actually “real time data”?

[Q] Will I have this problem if I try my algorithm with a stock like IBM on SMART?

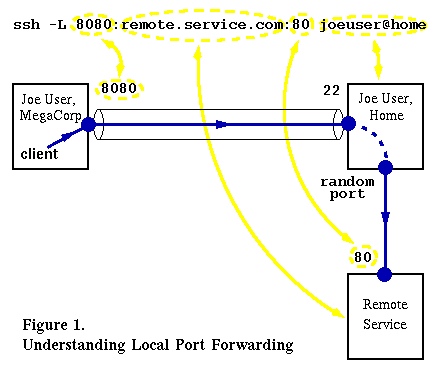

[Q] I am behind a firewall. I like to know the TWS outbound ports?

[Q] Any general recommendations?

[Q] IB commission rate comparison

[Q] Notice of High Order Ratio

[Q] Some IB API timing requirements

[Q] How to turn off Security Code for TWS real account login?

[Q] How many market data lines one has subscribed to in TWS?

[Q] How to import Tickers from a File?

[Q] Link to the official server reset time?

[Q] How to check and solve connectivity issues affecting the Trader Workstation (TWS)

[Q] How to run 2 TWS on different machines (to access same account)?

[Q] How to optimize TWS Java VM performance? aka the "latest and greatest" JVM server settings

[Q] How to make TWS application running 24/7 automagically?

[Q] How to setup IBC in docker

[Q] Where do we get the latest versions of TWS API?

[Q] How to reset TWS connections?

[Q] which version of TWS should I use?

[Q] How to reset a paper account?

[Q] How API version maps to client/server version I see in a log?

[Q] How to change ib primary HOST? (moving to new region)

[Q] TWS SLOW connection times?

[Q] I'm a total noob, where to begin?

[Q] Where can I find C++ and C# tutorials/examples using ActiveX?

[Q] Where can I find working posix C++ code examples?

[Q] Where can I find MORE ADVANCED working posix C++ examples?

[Q] Pattern recognition library?

Quite random implementation notes (todo: sort or delete them…)

[Q] Does demo account API behavior differ from the behavior of real account?

[Q] How do I retrieve the bid/ask spread for a given contract?

[Q] How to close an OCA group?

[Q] Order field to identify a strategy? (clientID vs orderRef vs permID)

[Q] Detection of loss of connectivity

[Q] Get list of all symbols by exchange?

[Q] Getting stocks / options standard deviation?

[Q] How to detect TWS disconnected from API?

[Q] What value means "no value"?

[Q] Best practice to handle ID’s / nextValidId?

[Q] Tracking time (internally)

[Q] Why do we get two identical tickSize() callbacks?

see also somewhat related: [Q] Building live Trades

[Q] data links drop; feeds fade. Serious software needs to handle that. How?

[Q] Request/response/error architecture thoughts?

[Q] Thoughts on “duplicate requestID” value (bad value given by API)

[Q] Thoughts on “requestID space partitioned”

[Q] Trying to modify an order and sometimes FAIL!?

[Q] Trying to modify trailing stop, got an error 10067

[Q] Order execution messages considerations

[Q] Checking API connection / checking the timeliness of ticks

[Q] AvgPrice rounded to 2 digits, I want 3 digits!-)

[Q] How to get avgFillPrice for multiple filled order status updates?

[Q] Rounding to the tick size of the Financial Instrument

[Q] Should I use MKT or LIMIT orders? How do I track partial fills?

[Q] Why PosixMQ is a good idea for IPC? Why can’t I just use some thread-safe queue (with mutex)?

[some feedback from 100% complete frameworks out there;-]

[Q] Unit testing – which one to choose?

[other chaotic implementation notes]

[good implementation note on “designing stop-limit orders”]

Notes on ContractTracker implementation

Well known errors and how to avoid them

[Q] List of documented Error Codes?

[Q] reqSecDefOptParms() with exchange specified returns no data?

[Q] More on reqSecDefOpt(): how to use it to pull option chains?

[Q] Errorcode(110): The price does not conform to the minimum price variation for this contract

[Q] Errorcode(200) No security definition has been found for the request

[Q] Errorcode(300): Can't find EId with tickerId:40000001.

[Q] Errorcode(321): Missing exchange for security type FUT

[Q] Errorcode(321): Error validating request:-'rc' : cause – You must specify an account.

[Q] errorCode: '451', errorMsg: ''

[Q] errorCode: '456', errorMsg: 'Max number of real time requests has been reached.'

[Q] Error 481, Order size was reduced

[Q] (undocumented, seen on may 2005) Error 505

[Q] Errorcode(???) Order Canceled – reason:Order size exceeds amount allowed by fat-finger check

[Q] (undocumented, seen on Sep 2017, Apr 2020) Error 10187

[Q] Errorcode(10197): No market data during competing live session

[Q] Errorcode(1101, 1102): Error validating request:-'rc' : cause – You must specify an account.

[Q] Meaning of Message 1102 (2104, 2106)

[Q] error 2137 The closing order quantity is greater than your current position

[Q] Order size is too large IB limit is 35000

[Q] First order after IB GW API connection causes disconnect and order is ignored

[Q] What is the difference between contractDetails.liquidHours vs contractDetails.tradingHours?

[Q] Exchange list in ContractDetails?

[Q] Change of Timezone specs in contract details?

[Q] Is there a way to get a list of all indices available on IB? (aka "Product Listings")

[Q] What algos IB provide to place orders?

[Q] What do I need to know about orders in general?

[Q] What order types are supported by IB?

[Q] I sent an order, what should I expect next?

[Q] How can I trade stocks during the pre-market or post market?

[Q] execDetails vs orderStatus

[Q] How do I query the status of my orders?

[Q] Should I request contract details before placing an order? (yes)

[Q] Retrieving past trades in an account

[Q] How to distinguish Client ids from API vs non-API?

[Q] Where to Set GTC in placeOrder API?

[Q] "update order" VS "cancel and creating order"?

[Q] How often can I modify an order?

[Q] How to change the limit price of an order without changing order size after partial fills?

[Q] I’m getting multiple filled orderstatus updates

[Q] Ok! Order executed! But what was the fill price?

[Q] Order Id mismatch between API and TWS

[Q] Why my order has “Inactive Order” Status?

[Q] How to cancel all open orders and close all positions?

[Q] How to pause order (like in TWS)?

[Q] I got multiple execution messages.

[Q] How to submit a sell order as soon as a buy order is executed

[Q] How do I know if my stop order is triggered from API message?

[Q] Should I use IB’s trailing stop and other advanced order types?

[Q] OCA orders are simulated orders?

[Q] MOC (Market on Close) orders and OCA Group

[Q] Code: 201 – Order rejected – reason:The OCA group order has already been filled

[Q] SHORT selling (SSHORT vs SELL)?

[Q] Changing Order Quantities while order partly filled.

[Q] How do I get commissions from API?

[Q] Also if I want to see the sum of Commissions in a given day from API ?

[Q] How to check the date when the current position was acquired?

[Q] Can I use just conId for specifying the contract?

[Q] My order’s place in line!?

[Q] Max usage of buying power for DT system

[Q] openOrder / orderStatus / execDetails sequence?

[Q] How to modify the submitted order?

[Q] error: The price does not conform to the minimum price variation for this contract

[Q] Sometimes reqOpenOrders will not return all open orders. wtf?!

[Q] I have not able to retrieve the previous filled orders through the reqExecutions call

[Q] How to submit a vwap order with start and stop times and other options?

[Q] Relative Order transmit problem

[Q] How to send post-only order by api?

[Q] How to suppress: Price Management Algo Popup

[Q] How can I know when a stop limit order is triggered?

[Q] How place orders before AND after market hours?

Combination Orders (aka combo order)

[Q] How would I set the Order::lmtPrice field for a combination order?

[Q] Please explain how to handle combo orders?

[Q] Understanding Guaranteed vs. Non-guaranteed Combination Orders

[Q] How to create option combo leg without knowing the conId of each leg?

[Q] Non-Guaranteed Combination Orders

[Q] Note on the Bracket Order child order allowed types?

[Q] Bracket Order Quantity is capped? (yes – by parent's qty)

[Q] Margin for generic orders basket, multiple leg

[Q] Bracket order: Why Sell and Stop don’t cancel each other?

[Q] Bracket orders: 3 or more childs? grand child? stop order as an entry?

[Q] Bracket orders: edge cases

[Q] Bracket orders: How to place bracket order via API (recap)

[Q] How to modify pricing on a bracket order?

[Q] What "Order Inactive" really means?

[Q] What is the IV in options model used by IB?

[Q] How to get Option BID/ASK and GREEKS after the market close?

[Q] How to get daily volume for options?

[Q] See also: How to request contract details in order to get the options for a specific future?

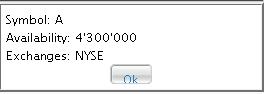

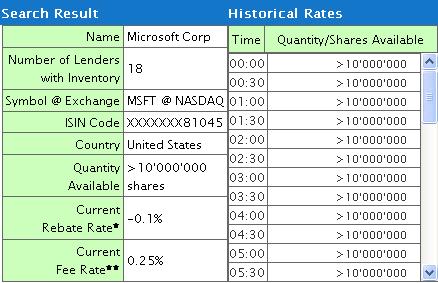

[Q] How to Monitor Stock Loan Availability?

[Q] How should an API client detect an option exercise, the exercise being done manually in TWS?

[Q] How to find out available strike prices for options ?

[Q] How to get all valid options (scrape option chains)?

[Q] How to pull the entire option chain?

[Q] Why option chain data is delayed (sometimes up to 1 minute)?

[Q] Is IB’s model reliable or useless and I need to do all the calculations myself?

[Q] Am I required to pay the dividends on shares borrowed when short selling?

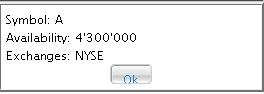

[Q] Which stocks are shortable which are not?

[Q] How to determine the pricing step for an option?

[Q] placeOrder() No security definition has been found for the request

[Q] I see duplicate events from time to time!

[Q] Bad equity options spread (bid-ask seems to widen significantly)

[Q] Can I use SMART for futures?

[Q] How to request contract details in order to get the options for a specific future?

[Q] Futures – No security definition has been found

[Q] Can I place MOC order for es future?

[Q] Futures options data via API

[Q] How to get Futures Front Month

[Q] continuous contracts rollover schedule

[Q] Continuous contract – how to determine offset?

[Q] Futures: what is “First Position Date”?

[Q] Get info on all legs of placed combo order?

[Q] Note: good-after-time (GAT) orders are not supported for ("generic") combo orders!

[Q] Can place orders for each leg, but can’t place combo!? wtf?

[Q] Is there a way to get contract details of the BAG contract itself?

[Q] IB Lag with Combination Orders

[Q] Can’t change qty on combo order!

[Q] How to get all Completed Trades within the last N days?

[Q] tell me more about Flex Query

[Q] Accuracy of paper-trading account

[Q] PaperTrading – how do they simulate fills on limit orders?

[Q] Paper account vs. Demo account?

[Q] Partial fillings of MKT order on paper trading account? wtf?

Limitations of the PaperTrader

[Q] Trying to place pegged to stock orders through API or TWS via paper account?

[Q] Any easy way to do charting?

[Q] reqFundamentalData() – How to Parse XML File?

[Q] How often Fundamental data updated?

[Q] Why only 4 out of 6 fundamental requests succeed and for 2 of 6 I got errors:

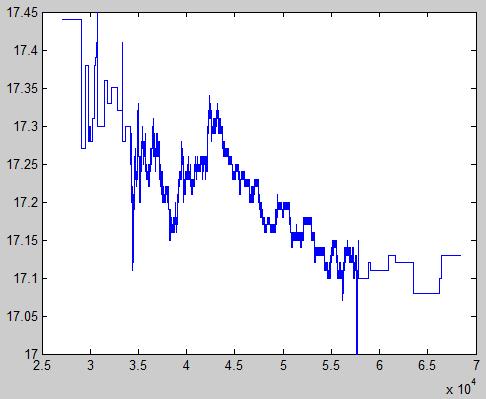

[Q] How IB throttles / samples it's level 1 data? (aka "best description of

what's going on with the IB feed")

[Q] NYSE auction order imbalance data?

[Q] How to download broad market statistics, such as NYSE TRIN, NYSE Advancing issues, NASDAQ ?

[Q] Trust daily close or 1-minute data close?

[Q] Realtime Volume timestamp sometimes goes backwards?

[Q] Is there an easy way to get the S&P 500 index component stocks?

[Q] My accumulated volume does not match the TWS one! Wtf with VOLUME?

[Q] Does it make sense to use separate data / broker connections for separate tasks?

[Q] How to get the day open price for NYSE stocks?

[Q] How to get Futures Open Interest?

[Q] How to get somewhat accurate cumulative volume?

[Q] Dividend Calendar (dec, rec, div, exdiv, amount, etc)

[Q] Dividend Adjustments? Adjusted Previous Close not available on IB?

[Q] API reqFundamentals dose not return previous dividend data for index

[Q] Data subscription: Calendar events

[Q] I got invalid update of bid/ask which leads to CROSSED PRICE. wtf?

[Q] Crossed quotes on IB (again)

[Q] Snapshot market data vs “real time” data.

[Q] Market Data Stuck when requesting snapshots!

[Q] reqRealTimeBars vs reqMarketData – how to get real time bars?

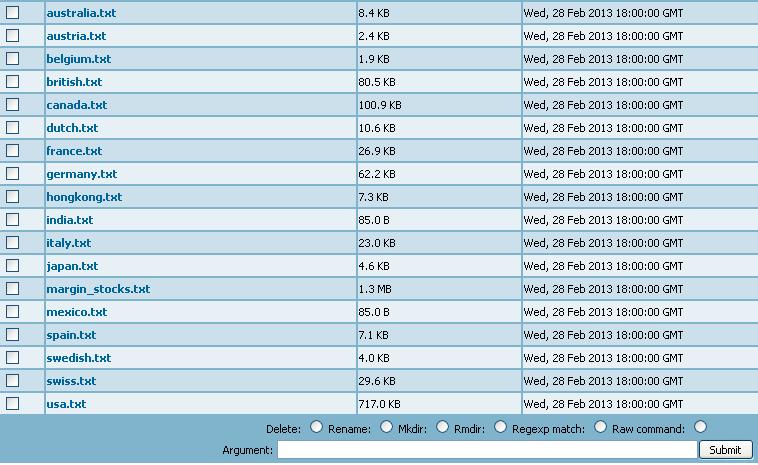

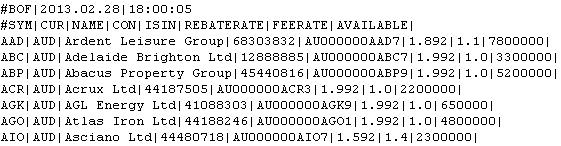

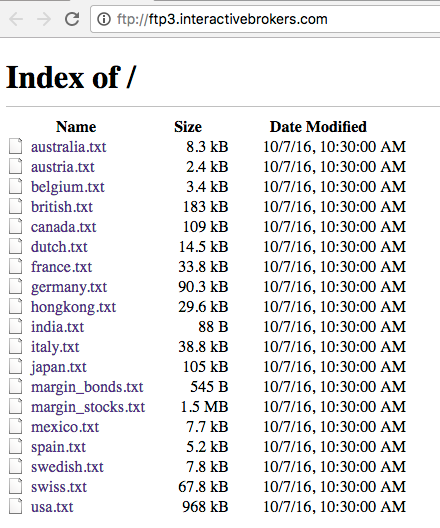

[Q] How to get list of all IB’s tradable contracts?

[Q] Sometimes lastSize=0. wtf?

[Q] What are the differences between Level I and Level II data ?

[Q] Which request ID should I use?

[Q] How deep can I go in history?

[Q] high, low, close fields in tickPrice ?

[Q] What is the sequence of tickSize() tickPrice events?

[Q] I get negative and zero quotes! wtf?

[Q] How to get all strike prices for a given ticker & expiry?

[Q] No security definition has been found.

[Q] reqMarketData(): For most stocks I get the last prices, however for some stocks I only get bid.

[Q] reqMarketData(): sometimes getting back tickPrice events with a price of -1

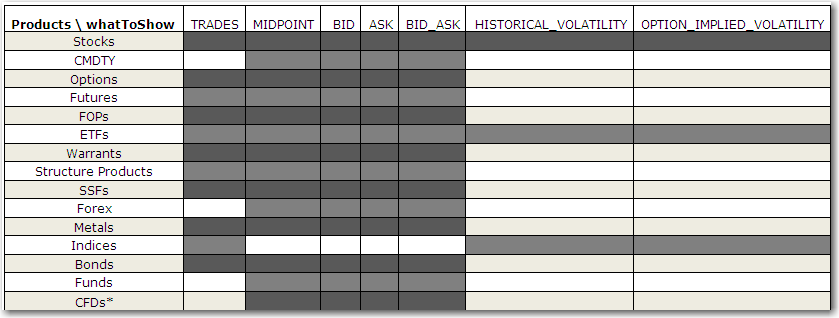

[Q] reqRealTimeBars() – "whatToShow" string?

[Q] reqRealTimeBars() – only 5sec bars available? Partial bars?

[Q] tickPrice(): canAutoExecute field – wtf?

[Q] Is it possible to develop TWS like depth book using reqMktDepth() call?

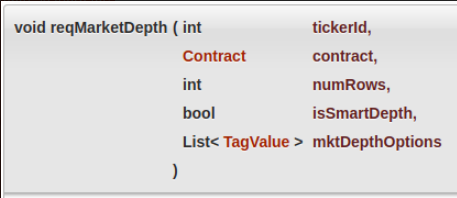

[Q] implementation notes: reqMarketDepth

[Q] What happens when I do reqMktData() afterhours?

[Q] can reqTickByTickData get delayed ticks?

[Q] How to get all S&P 500 stocks in 26 seconds?

[Q] What are Pacing Violations?

[Q] Can I be long and short on the same underlying same time?

[Q] Any historical-data aggregating programs?

[Q] Is HistoricalData volume represented in the hundreds?

[Q] Can I get historical price data of instruments which have expired?

[Q] Can I download the historical data of obsolete symbols?

[Q] How to get historical data split and dividend adjusted?

[Q] Bug in historicals? Price but no volume and other historical “holes”!

[Q] How to store historical data?

[Q] reqHistoricalData: Volume vs Count?

[Q] Volume looks incorrect for indices historical data?

[Q] How to get indices historical prices?

[Q] When requesting historical data I often get “Invalid step”

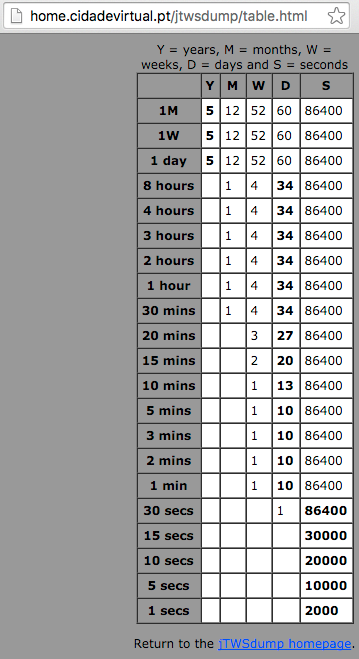

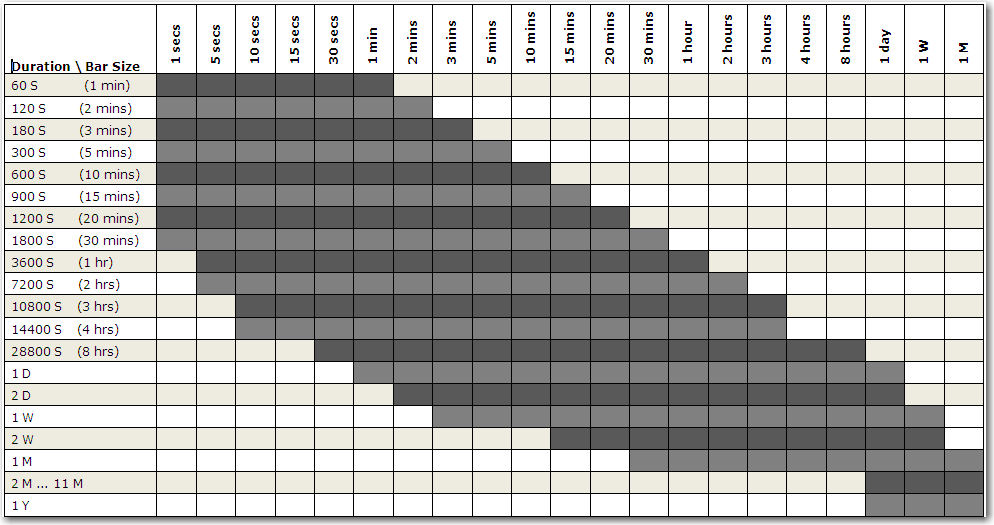

[Q] Valid Duration and Bar Size Settings for Historical Data Requests

[Q] Can't get some Forex historical data?

[Q] IB's own historical data corrections (history of the history:)

[Q] Where do I begin with scanners?

[Q] Biggest gainers since open between $5 and $10?

[Q] Market Scanner Pre/Post Market Hours

[Q] Trouble getting API scanners to output the same date as the one in TWS!

[Q] Give me simple example of working scanner request.

[Q] Can't get scannerSubscriptionOptions to work

[Q] Note on contracts which may not be accessible through TWS when running scanners:

[Q] Market Scanner Pre/Post Market Hours:

[Q] How to find the location code for Australian when creating a scanner subscription object?

[Q] When subscribing to a news feed via API, is it possible to receive the rank? If yes, how?

[Q] Installing IB Gateway and TWS API for linux?

[Q] Trader Workstation (TWS) vs IB Gateway?

[Q] Any performance difference between IB Gateway vs TWS app APIs?

[Q] Gateway Crash on Startup – Linux

[Q] list of the error 321 "message is not supported"

[Q] autologin script for IB Gateway?

[Q] IDEALPRO LMT orders at the top of the order book never executed

[Q] Please check my Forex math!

[Q] according to the documentation m_avgPrice should include commissions, but it doesn’t!!

[Q] Can't get some Forex historical data?

[Q] Why I don’t get TRADES from “real-time” FX ticker?

[Q] Minimum size requirements for IDEALPRO

[Q] Using Managed Accounts: How to set deposit size on subaccount / disable loan?

[Q] Best take profit order type

[Q] contract->exchange = "SMART" works, but contract->exchange = "NASDAQ" does not!

[Q] IB technical support contact info?

[Q] Fully clarifying exchange vs primaryExchange

[Q] I need some actively trading stock for my midnight debugging

[Q] Where do I get the latest standalone TWS?

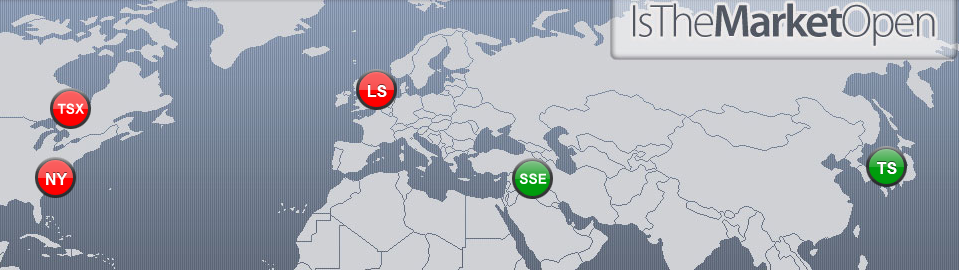

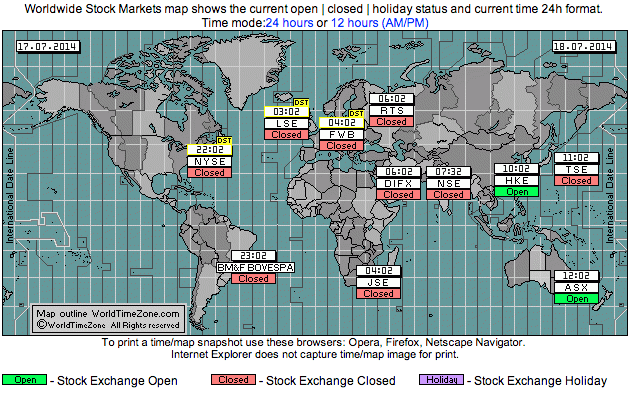

[Q] How do I know if the market is open via API?

[Q] How to get account balance, transaction fees, cash transactions, Net Asset Value, etc.? (Flex?)

[Q] How to automate Flex Reports?

[Q] Which Java is better to use for TWS on Ubuntu?

[Q] Is there any way to see S&P 500 index on TWS?

[Q] Release notes – should I read it?

[Q] French transaction tax, how to anticipate?

[Q] Getting exchange location for order?

[Q] What is the "numIds" for in reqIds function?

[Q] Does anybody know of a free technical analysis libraries?

[Q] Is there a way to pull these daily libor rates directly from TWS?

[Q] Closing Prices in TWS Are Wrong?

[Q] How to update the future's margin requirement from TWS API?

[Q] How to get margin requirements for possible trade?

[Q] Is there a way to automate retrieving margin reports?

[Q] Figuring out Lookahead / Overnight Margin Rate For A Stock

[Q] Index of all available addons that can be purchased for tws?

[Q] Reverse engineer IB API socket protocol

[Q] Read this later for TAX purposes (if you ever need it at all)

[Q] Can I get the MarketValue for all the currencies?

[Q] Getting a full list of Exchange Listings via API?

[Q] orderStatus function is be called 3 or 4 times(!) even when there is no update of status. Wtf?!

[Q] How to obtain the complete current portfolio?

Not yet confirmed Q/A's (todo: confirm/test or delete them…)

[Q] Validity of Paper Account for Testing Algo Trading Outcomes?

[Q] Other limits I’d be aware of?

[Q] there is no correlation between bid/ask and trades in IB's feed (?!!)

[Q] updatePortfolioEx() non consistent behavior?

[Q] How to monitor events (keyboard, mouse) in X?

[Q] Does my/your/any computer have a time drift?

[Q] Should I build my own NTP server (on my LAN) or would it be sufficient to just use public ones?

[Q] How to build own Stratum-1 NTP server on Raspberry Pi?

Some unsorted yet related stuff

About this FAQ

Purpose

Let us learn and make TWS API better and easier to use/understand.

This document is Dmitry’s personal attempt to learn TWS API and 99.9% of its content came from TWS API Group https://groups.io/g/twsapi. I tried to structurize some questions and answers in form of FAQ grouped by topics.

Scope

I tried to collect all the general Q/A’s about data flow, tricks of certain functions of TWS API, limitations, workarounds and other general-level info. On the lower-level side of things (language specific) I collected mostly C++ / Java related topics and did not store much on topic of Windows Sockets, ActiveX, CSharp, VB or DDE for Excel etc. Want to add missing topics? You’re welcome to participate and add it yourself! 🙂

In Dec-2014 I started digging (reading through) all the history starting from messages around 05-Feb-2010 and this FAQ is an ongoing attempt to keep track on all important topics.

Disclaimer

This FAQ represents a small fraction of the TWS API Group discussions and by no means is intended to replace one. Please search online group archives for many more answers (than you can find here).

Link to the latest IB API documentation

[A] by Josh

On Wed, May 3, 2017:

The newer documentation is at: http://interactivebrokers.github.io/tws-api/

by the way.

Josh

–also–

———- Forwarded message ———-

Date: Thu, 18 May 2017 17:29:38

From: jbeacomib <notifications@github.com>

Reply-To: InteractiveBrokers/tws-api

To: InteractiveBrokers/tws-api <tws-api@noreply.github.com>

Subject: gh tws-api] Stale IB doco relative to the github content (#493)

The documentation which is actively updated with the most

current information about the builds of TWS and API versions

that are on the website (API versions 9.72, 9.73) is hosted on

[Github](http://interactivebrokers.github.io/tws-api/)

The older documentation was created for version 9.71 of the

API and previous builds of TWS. It is now no longer updated

and has been superseded by the Github documentation site. The

new documentation is correct that up to 32 API applications

can now be connected to one instance of TWS or IB Gateway.

However in practice, this limit is uncommonly reached as it is

usually more efficient to reduce overhead with a smaller

number of connected clients.

Basics for beginners

You should always try the corresponding functionality in TWS. If it

doesn't' work in TWS either, then it is not an API problem. (Kurt)

[Q] Vocabulary

[A]

ATS – automated trading system

BBO – Best bid offer (NBBO = National BBO) (RBBO = Regional BBO)

DOM – Depth of market

CFD – Contract for Difference

GAT – good-after-time (GAT) orders

MOC – market on close order (example: MOC order in an oca group)

MOO and MOC work for U.S. stocks. Check the IB website for other markets.

One catch for MOO orders is that you have to specify "OPG" for the time-in-force.

Also, these order types can not be canceled after a specific time. I

haven't done this is in a while but it used to be for stocks you could

not cancel a MOC after 3:50 pm NY time. Be sure to research all the

details before you place these order types.

MOO – market on open order

OCA – once-cancels-all

OCO – one-cancels-other (when one order executes it will automagically cancel another order:)

Note about OCA/OCO: by Richard L King from this thread

There is no guarantee that this will avoid the problem. Where two orders in an OCA group have fairly close prices, it is possible for both to be filled in a fast market. This is because when the first order is filled, IB cannot know to cancel the second order until it has received the fill notification for the first from the exchange, and it then has to transmit the cancellation to the exchange: during this time the second order could be filled.

This did actually happen to someone a few years ago, and they complained to IB, but IB (quite rightly) pointed out that they cannot make any guarantee that only one order in an OCA group will be filled.

A much safer approach is to simply use a single stop loss order, and adjust its price as required: it can be included as a child order when the entry order is submitted, and with a wide stop for safety. Once the entry order has filled, the trigger price for the stop loss order can be tightened as required, and subsequently adjusted as profit increases.

RTH – regular trading hours (like 9:30 to 16:00)

NBBO – Relative (a.k.a. Pegged-to-Primary) orders provide a means for traders to seek a more aggressive

price than the National Best Bid and Offer (NBBO)

VWAP – volume weighted average price

[Q] Limitations on quantity of symbols?

[A] from IB website

All customers initially receive 100 concurrent lines of real-time market data (which can be displayed in TWS or via the API) and always have a minimum of 100 lines of data. Customers can increase the allowance of simultaneous quotes windows by purchasing monthly Quote Booster packs.

[Q] Where can I find the API version info?

[A]

C:\Jts\API_VersionNum.txt

[Q] I’m about to post a question to IB API list. What should I do?

[A]

1. do basic google search for your question before asking your [Q]

2. search TWS API archives for some of keywords related to your question

3. sure, nothing found.. you’re writing your post to The Group

– include the API type that you trying to use

– try to include what exactly you’re sending to API

– what replies (in form of callbacks) you receive?

– are you logging all the possible API callbacks or may be you just missing one

thus thinking “I did ABC, but nothing happened…”?

– generally try to be precise (not vague)

– try not to send more than 10 posts/day 😉

(Few thousands subscribers will have to read it. Have some respect:)

[Q] Number of hops to IB?

[A]

Has anyone else experienced HDMS market data connection issues since upgrading

to 906?

I couldn't get a stable connection so I downgraded back to 900.

Support is telling me I have too many hops in my tracert! Apparently the support

engineer thinks British Telecom will reduce them for me down to 15 (from 26) if

I complain, or else change ISP!

— Adam Hardy

I always used to ping gw1.ibllc.com

Right now I get about a 50 msec avg round trip from North Carolina, USA on

Road Runner Turbo over 14 hops.

— FutureScalper

others:

—

14 hops, 55ms here (16Mb comcast business class)

—

9 hops, 37ms (Small Co-Location facility in Maryland)

—

In relation to connection speed, just reading the other current thread, tracert

shows I am 25 hops from the server at 200ms – I'm in Europe – and the IB support

staff say this is not a guaranteed good connection 🙁

Ping @ 95ms each.

—

[Q] Is IB real time data actually “real time data”?

[A] (investigate more)

IB's data is not "live" to begin with. it's series of snapshots with 5-30 ms intervals(don't remember exactly, you can check TWSAPIgroup on yahoo-there is very detailed explanation somewhere about how IB deliver the data). bottom line-it's not live and this is why IB's data usually doesn't lag at the open or during Fed announcements. so-there is no such thing as "fast market" for IB's data

— also —

You would not expect IB's ticks to match anyone else's. You are aware that

IB's ticks are sampled?

-Kurt

I don't keep the exact details of it in my head, but it is something like a

limit of 10 ticks per second that is imposed, with a higher rate I think for

certain types of instruments. (Someone posted definitive information on

this a few months ago but I can't find the message.)

-Kurt

— also —

IB feed have a high enough resolution to do some meaningful work..

— also —

But if you need unsampled tick data you need to go elsewhere to get that

data.

-Kurt

— also —

this is an excerpt from emini-watch.com :

"The IB data feed available via their Trader Workstation Software (TWS) is not a true tick-by-tick data feed. IB provides snap shots of the trade data several times a second with an aggregate of the trades that took place during that interval. As a result time-based charts (e.g. 5 minute charts) will be correct, however, tick charts will not."

— also — by rwk0434 at gmail.com (src):

There are actually three ways to get data that may be creating some confusion: 1) reqMktData(), 2) reqHistoricalData(), and 3) reqRealTimeBars(). Historical data comes from a different server farm, posing an obvious source of discrepancy. I am not sure whether realtime bars are built on the primary data server or the historical server, but they appear to have fewer data discrepancies for some applications.

It is well-know that IB data is sampled. (Also note: Stock data is sampled all 250ms and options data all 100ms.) The sampling rate is about 3/second, except for some GLOBEX markets where it is 10/second. Less well-known (to me anyway) is that some venues have started distributing conflated data. If you trade stocks and have been following the HFT saga, you probably know that there are data feeds that run ahead of the official SIP feed.

This brings up the question of how usable the IB data is for active trading. It's my belief that we can have completeness or timeliness, but not both. IB has chosen timeliness, and that is my preference as well. If you need completeness, you should consider other data feeds. If you want both, you will need expensive infrastructure such as co-location.

For traders organizing their data into bars, the effect of sampled data is that occasionally a bar will be missing a high or low, usually by just one tick, though it could be more. Many traders find that unacceptable. I am skeptical that the data discrepancy will affect long-term profitability very much. It's hard to imagine how avoiding these occasional data discrepancies would justify the added cost of more extensive infrastructure.

[Q] When I pass a BUY LIMIT order on the ES, let's say at 1300.25, I always have to wait until the price goes to 1300 to get a fill…is that normal?

[A] by rwk 2095 from this thread

I'm not an expert on the ES, but I will try a comment anyway. When you are using an order type that is native to the exchange ('limit' is native to Globex), there is almost no difference from one broker to another unless you are doing high-frequency trading (HFT). Your order goes to the back of the queue. For a very busy market such as ES, you won't get a fill very often without the inside price moving past your order.

If you're using a non-native order such as 'stop', your order is simulated on the broker's server, and delays can be quite substantial. It's best to avoid non-native orders for that reason.

If you're trading a market that doesn't have a central limit order book, such as the U.S. stock market, there is a lot of difference in quality of fill among brokers. IB has a generally good reputation.

[rwk]

[A2] by poch32

Keep in mind that each DOM level has a FIFO queue. If there are, let's say, 50 contracts for sale @ DAX 7002.5, and yours happens have arrived in place #48, you can easily see that – in practice – you will need the price to completely fill the whole 7002.5 level and go down to 7002.0 to garantize yourself a fill.

[Q] Will I have this problem if I try my algorithm with a stock like IBM on SMART?

[A] by Eric J. Holtman from this thread

It will be infinitely worse with stocks.

At least with the Emini, you've got one central computer

doing the order matching, and assuming everything is

fair, you just wait your turn and get a fill.

Here's what will happen with, say, IBM@SMART.

NBBO is 104.14 x 104.16. Let's say you put in an

order to buy @ 104.14. IB needs to pick one of the

many exchanges to send your order to.

Suppose it picks wrong. It's possible that your order

won't get filled, even if the stock trades all day

at 104.14.

It's also possible for you to not get a fill if the

stock trades at 104.13. Now, in that case, you can

try to file a report with IB. They'll go look at

tapes (if you're lucky), and you *might* see a price

improvement or a fill.

You might not, too. You'll be told any number of

excuses, but bottom line is, sometimes, you just

won't get a fill you think you "deserve".

Now, this isn't just small retail guys getting clipped

for a penny on 100 lots. I used to work for a fund

where we were throwing around tens of thousands of

shares, we had prime broker relationships with big

Wall Street banks, we had >$100mm AUM, and we still

got hosed by "trade throughs" all the time.

It's a price of doing business.

And all the above is just related to actual "trade

throughs", which should be illegal (or quickly fixable)

but in practice, you just have to eat them. On top

of that is just everyday, garden variety slippage:

You see IBM at that same 104.14×104.16. You submit

a market order, expecting 104.16. You get 104.18.

Welcome to trading!

[Q] I am behind a firewall. I like to know the TWS outbound ports?

[A] by Kurt

Googling "tws ports" takes me to this IB page:

http://www.interactivebrokers.com/en/general/education/faqs/technical.php

They mention 4000 but I seem to recall I had to open 4000 and 4001 to get it

working. If you get it wrong you will find out quickly.

However there are other ports for things like news feeds. If you run

netstat with the right args (netstat -a I think) you will see all these

things and as I recall they were all pretty obvious from the url that

appears in the listing.

-Kurt

[Q] Other TWS API FAQs?

[A]

https://www.interactivebrokers.com/en/general/education/faqs/technical.php

[Q] Any general recommendations?

[A] by Steve Novotny

I can save you a lot of time: people who want to constantly babble online

about their systems don't have one (which profits, anyhow). People who want

to talk constantly about this and that indicator, and pivots, and technical

analysis, and blah blah blah have never made a nickel trading.

..and people who HAVE come up with a way to profit while sleeping aren't

telling anybody ANYTHING. (the exception to the last two paragraphs may be

those who have found something that, by coincidence, works for AWHILE-long

enough for them to get excited J )

You will save yourself a TREMENDOUS amount of time if you read NO BOOKS

about trading, join NO GROUPS discussing trading, and buy NO MATERIALS

related to trading. Instead, look at historical prices a LOT, brainstorm

about how one might win (which, I can assure you, will be NOT OBVIOUS OR

SIMPLE), then TEST your ideas in a statistically responsible manner.

— also —

Hi Regis,

You might want to join Elite Trader forums. They talk about such things all the time.

Also, if you want a more mathematical insight into things, look at QUANT Finance forums such as Wilmott, or http://www.quantitativefinanceforum.com/

For books, start with Irene Aldridge's book on "High Frequency Trading" and Ernie P. Chan's "Quantitative Trading". Both are quite Easy reads.

You may also want to look into "Statistical Arbitrage" by Andrew Mole.

These should be a good starting point for you.

Steve.

[Q] IB commission rate comparison

[A] https://www.interactivebrokers.com/en/?f=commission#options-clear

[Q] How to sync market data?

by israelieyal: hi all,

i'm using IB to capture real time market data.

right now, i keep it simple and only use reqMktDataEx and listen to the results on the tickPrice and tickSize event Handlers.

this work fine.

my question is how do i know all data (bid, ask, last etc.) is synchronized? for a given time, how do i know all these components (bid, ask, last – sizes and prices) are the actual values for that time?

i'm sure that's a question that a lot of programmers were faced into. i'll be glad to hear your ideas/opinions.

thanks

[A] by Eric J. Holtman

First, the IB data is sampled, so it's *never* actually correct.

Second, there are no timestamps delivered with the data, so there

is no way to tell if it's a late report from an exchange.

Third, quotes can be quite old…. if a stock is thinly traded,

you may receive any updates for seconds, or even minutes.

— Eric

[A2] by skunktrader2001

They are not synchronized. The feed is designed to update a grid.

[Q] Notice of High Order Ratio

[A] by Orionn

just got this from IB:

"Dear Trader,

We have noticed a very high ratio of orders and order modifications

relative to the number of executions in your account ******. Every order

instruction submitted by you (includes new order submission, order

modification, cancellation) utilizes computing power. Excessive order

activity can slow down IB systems and negatively impact other clients.

IB monitors order/trade ratios to prevent excessive and unnecessary

system resource utilization. As a general rule, a ratio value less than

10 order actions per 1 execution will generally be acceptable, although

fees may apply for certain markets where the ratios exceed 5:1. Above

20:1, IB will request clients using automated order management tools to

optimize their order management behavior. Above 100 orders per

execution, or if our analysis indicates a systematic misuse of IB's

automation services, IB may take steps to reduce the system utilization

including: charging a fee for order modifications (typically 20% of the

commission for an execution), or limiting access to API services.

Most of the time, excessive order/trade ratios are caused by poorly

optimized APIs or other order creation programs. These applications

generate price changes that do not materially alter the likelihood of

the order being filled. By example, when a stock is quoted 50.0-50.2,

then an order change from 45 to 46 does not really change the likelihood

of execution.

Most clients are able to easily improve their order management by

introducing 'no-waste' logic into their systems. We kindly request you

examine your order management logic to reduce unnecessary orders to the

recommended levels."

…

"For additional information, including suggestions as to how to reduce

waste in your order management behavior, please type KB1343 ( IB../1343

) into the search engine located on the IB home page or contact our API

services group at api@interactivebrok ers.com

Interactive Brokers Customer Service"

read more:

https://groups.io/g/twsapi/topic/4044829

ZenFire seems a very attractive choice from a programmer's perspective

[Q] Some IB API timing requirements

[A1] by Bill Pippin (from this thread)

The api not only imposes timing requirements on requests in

general (20 msec for the IB tws, or ~6 msec for the gateway); it

also routinely rejects child orders that follow too closely on the

heels of the parent (folklore says 300 msec here); same symbol

history queries at the rate of more than 6 each two seconds; and

history queries in general, at the rate of more than 60 per ten

minutes. Worse yet, the history query pacing requirements seem to

be enforced by the upstream, so there are possible races caused by

network jitter to contend with.

[A2] by Angel@IB support by phone:

. The limits I referred to was the reqContractDetails( ) limit, please see the details below:

Note: IB implements a limitation when invoking reqContractDetails( ) that will buffer the contractDetails( ) call back for any subsequent requests from 5 – 60 sec. To avoid the pacing limitation (up to 8 requests) it is essential that the FULL expiration is provided within the m_expiry parameter in the format YYYYMMDD as well as the Strike, Right and Multiplier. Otherwise if you request contract details providing the exact parameters outlined above it would be buffered by 5 sec.

For Examples:

If Expiry = Blank or NULL

Symbol = “IBKR”;

secType = “OPT”;

Expiry = “” ;

Exchange = “SMART”;

Currency = “USD”;

Above example, if the expiry is assigned to null or empty string, the delay is 1 minute.

If Expiry = YYYY (e.g. 2014)

Symbol = “IBKR”;

secType = “OPT”;

Expiry = “2014” ;

Exchange = “SMART”;

Currency = “USD”;

Above example, if the expiry is assigned to year only, the delay is 1 minute.

If Expiry = YYYYMM (e.g. 201402)

Symbol = “IBKR”;

secType = “OPT”;

Expiry = “201402” ;

Exchange = “SMART”;

Currency = “USD”;

Above example, if the expiry is assigned to year and month format (YYYYMM), the delay is 5 seconds.

If Expiry = YYYYMMDD (e.g. 20140221)

Symbol = “IBKR”;

secType = “OPT”;

Expiry = “20140221” ;

Exchange = “SMART”;

Currency = “USD”;

Above example, please note, that this ONLY works with front month option contracts, if the expiry is assigned to year with month plus the day (YYYYMMDD), then there is NO delay.

With regards to the historical data pacing limits please refer to the following URL:

https://www.interactivebrokers.com/en/software/api/apiguide/tables/historical_data_limitations.htm

Regards,

-Angel

IB API Support

TWS application related

[Q] How to turn off Security Code for TWS real account login?

Added on 09-Jul-2020

There is a setting for this at online Account Management. Follow this:

Online account → Settings → User Settings → Secure Login System → Secure Login Device Opt Out → tick the box at “I only want to use my Secure Login Device when logging into Account Management”.

Then press "continue". You will be presented with some disclaimer forms which you have to acknowledge.

If you later change your mind you are able to enable 2FA again, using the same procedure.

I hope this helps.

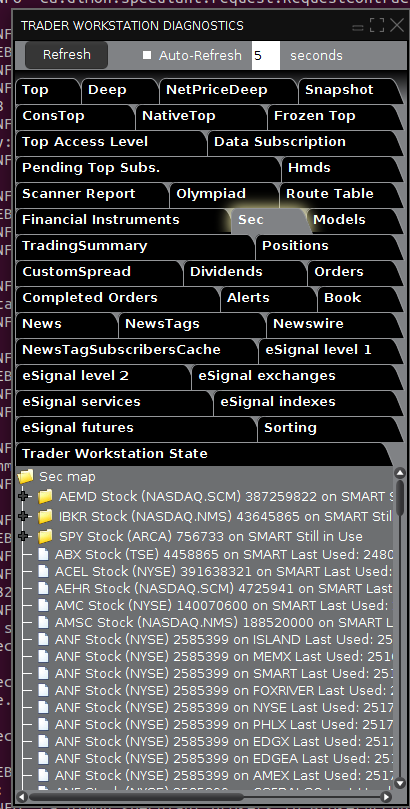

[Q] How many market data lines one has subscribed to in TWS?

[A] View/Reply Online (#43856)

Added on 23-May-2020, 14-July-2023

Press Ctrl-Alt-= simultaneously on your keyboard, TWS will show pop-up window with number of lines used.

Also try to press: Ctrl-Alt-C C

(I had to hit it couple times before Ctrl-Alt-C started showing up diagnostics window).

It'll show diagnostics window with a lot of useful information including the actual individual lines of market data you're subscribed

You'll see something like this:

See also:

Article: Why do I receive a message stating market data is over the limit?

Available here: https://ibkr.info/article/3292

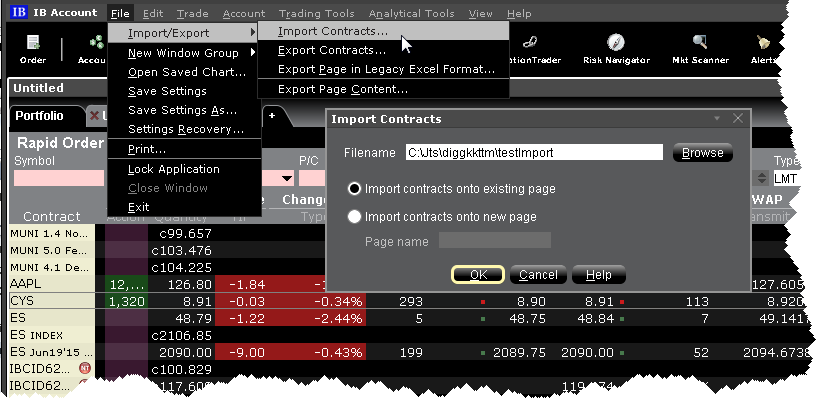

[Q] How to import Tickers from a File?

[A] discussed here (View/Reply Online (#43800))

https://www.interactivebrokers.com/en/software/tws/usersguidebook/getstarted/import_tickers_from_a_file.htm Here's copy-pasted article from IB's website in case the link above no longer works:

|

Import Tickers from a File You can populate a trading page with market data that you import from a comma-delimited .csv file or .txt file. Create the list using any word processing program and save the file with a .txt file extension, or in MS Excel and save as a .csv file. To create file of ticker symbols to import

DES, UNDERLYING, SECTYPE, EXCHANGE, LASTTRADINGDAY, STRIKE, PUT/CALL, MULTIPLIER SYM, SYMBOL, EXCHANGE CON, CONID, EXCHANGE The DES line type requires information or placeholders for information, with the strike, Put/Call and multiplier fields being optional. Format for the Last Trading Day is YYYYMM, or YYYYMMDD. All entries must be in caps. An example for an options contract XYZ would be: DES, XYZ, OPT, ISE, 201509, 75, CALL, A stock instrument for symbol XYZ in this line type would look like this: DES, XYZ, STK, SMART,,,, where the commas are placeholders for fields you don't define for stocks. Using the SYM line type for a stock would look like this: SYM, XYZ, SMART Use the CON type to quickly enter contracts with a conid, for example CON, 12348765, SMART To import a file into Classic TWS

To import a file into a Mosaic Watchlist 1. Right click in the Watchlist, and select Import/Export then Import Contracts.

2. Use the Browse button to find the file to import. 3. Click OK. Imported contracts entered onto an existing page appear at the bottom of the active trading page or Watchlist. |

|

[A] by Josh

typing a local symbol directly into an watchlist row will bring it up immediately, because it is unique to that option i.e. 'AAPL 200221C00322500' (make sure you have the correct spacing) Option Symbology Initiative (OSI) standard: https://ibkr.info/article/972

|

[Q] Link to the official server reset time?

[A] by Josh

https://www.interactivebrokers.com/en/index.php?f=2225

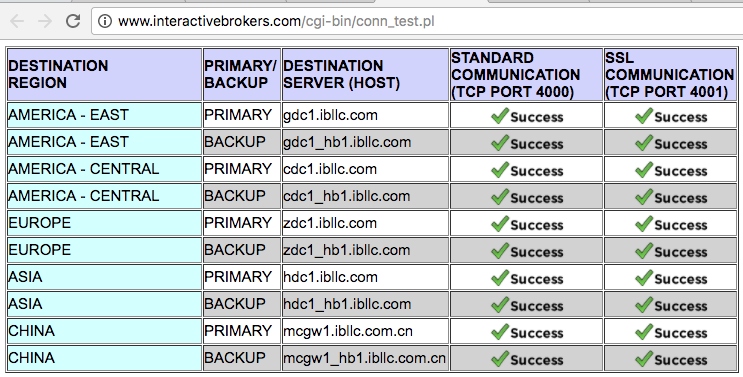

[Q] How to check and solve connectivity issues affecting the Trader Workstation (TWS)

[A] by Josh

https://ibkb.interactivebrokers.com/article/2807

(I’ll preserve a quote from the link above just in case here;)

Background:

The Trader Workstation (TWS) software needs to connect to our gateways and market data servers in order to work properly. Connectivity issues affecting your local network or your Internet Service Provider network may negatively affect the TWS functionality. In this article we will indicate how to test your connectivity using an automated connectivity test web page.

How to test the connectivity using the automated "IB Connectivity Test" web page?

1) Click on this link: http://www.interactivebrokers.com/cgi-bin/conn_test.pl

2) Please wait until all the tests have been completed and results have been displayed. If you see "Success" as outcome for all tests, your connectivity to IB Servers is reliable at the present moment. No additional connectivity troubleshooting or configuration should be needed.

3) If you see "Fail" as outcome for one or more test/s, please click on the link "Fail" itself in order to display the "IB Network Troubleshooting Guide". That section will help you conduct some manual tests to identify the cause of the failure.

Note for Corporative environments and Proxy server users: the automated "Connectivity Test" page may return misleading results in case your machine is accessing the Internet through a Proxy server. This usually happens if you are connected to a company network. If this is your case, we kindly ask you to contact your Network Administrator or your IT Team and ask them to perform a manual connectivity tests towards the destination servers indicated in the table on the top of the IB automated "Connectivity Test" web page itself. The manual connectivity test should be conducted using destination TCP ports 4000 and 4001. Should they prefer to have the server list in another format or should they need to set up the firewall / IP Management rules, you can forward them this page.

(end of quote)

[Q] How to run 2 TWS on different machines (to access same account)?

This question was posted on github ib-controller project:

Hi!

Any chance you can add a setting to deal with the "someone has logged in with this username from another location" scenario?

IB's "great" monster doesn't let you log in from two locations so I'd like to be able to login from my phone to check my portfolio at times that I know the TWS API will not be sending orders.

I would imagine it would click the button after some timeout.

Let me know what you think!

Thanks

Georgios

Added on 16-Aug-2016

[A] by Ben Alex

One option is a second username on your account. Full info at http://ibkb.interactivebrokers.com/node/1004.

[Q] How to revert installed version of API properly? aka downgrading API

Added on 29-May-2015

[A] by Richard L King (found here)

Well, I’ve discovered why I was unable to get any previous ActiveX API version working after uninstalling 9.72 Beta..

When you install the TWS API, the install process puts a library called TwsSocketClient.dll into the Windows system folder. This library has a file version number the same as the API version, and the ActiveX control (Tws.ocx) is actually a wrapper around this library, so Tws.ocx and TwsSocketClient.dll need to be the same version for the ActiveX API to be guaranteed to work properly.

The problem arises from the fact that when you uninstall the API, the TwsSocketClient.dll is not removed. If you now try to install an earlier version of the API, the existing TwsSocketClient.dll is not replaced, presumably because the version number being installed is lower than the one already there. So now the version installed does not match what the ActiveX control expects, and so it doesn’t work – at all.

So the solution is simply to manually delete TwsSocketClient.dll before attempting to install an earlier API version.

rholowczak, perhaps it would be useful including this info in your ActiveX tutorial? Most people probably never revert to a previous API version, but they may want to if, for example, they’ve been trying out a beta version and want to revert to the latest supported version.

[A2] by newguy@videotron.ca

Added on 30-May-2015

That's actually documented by IB.

Uninstalling and Re-installing the TWS API Software on Windows

|

|

|||||

|

|

Uninstalling and Re-installing the TWS API Software on Windows Open topic with navigation You are here: Overview > Uninstalling and Re-installing on Windows Uninstalling and Re-installing the TWS API Software on Windows |

|

|

|

|

|

|

|

|

|||

|

|

|||||

[Q] How to optimize TWS Java VM performance? aka the "latest and greatest" JVM server settings

Added on 27-Apr-2015

[A] by FutureScalper (found here)

you should use IBController by Richard L King

I would emphasize that the most significant thing you can do to improve

performance is to use the Java Server VM. I have a high performance

multi-threaded Swing-based GUI applications which does realtime analysis and

order processing, etc. It runs using the Server VM, even though it is a

"client" application. I also run TWS using the Server VM. This provides a

range of tuning options and global optimization capabilities which probably

doubles or triples throughput.

You can get the Server VM only by installing the JDK, and then you may want

to move the jvm.dll into your JRE area or whatever allows you to use the

command "java -server -version" to verify its installation.

Again, running TWS itself under the Server VM as well is critically

important for high performance.

Here is an example of the command line which I use to run standalone TWS

under the Java Server VM on Windows. Various options are technical, and

subject to change.

c:\WINDOWS\system32\java.exe -server -dsa -Xbatch -Xss192k -Xms200m -Xmx200m

-Xnoclassgc -XX:+ForceTimeHighResolution -XX:-TieredCompilation

-XX:+RelaxAccessControlCheck -XX:MaxInlineSize=64000

-XX:-DontCompileHugeMethods -XX:CompileThreshold=250 -XX:CICompilerCount=1

-XX:+UseConcMarkSweepGC -XX:MaxGCPauseMillis=150 -XX:+DisableExplicitGC

-XX:ThreadStackSize=192 -XX:+AggressiveOpts -cp

jts.jar;pluginsupport.jar;jcommon-1.0.0.jar;jfreechart-1.0.0.jar;jhall.jar;other.jar;riskfeed.jar;rss.jar

jclient/LoginFrame \jts

The Server VM will compile "huge" methods, and will "inline" code, and

perform global optimizationsn not possible with the standard Client VM.

Performance and scalability matter for many applications.

[Q] How to make TWS application running 24/7 automagically?

[A] you should use IBController by Richard L King

URL: https://github.com/ib-controller/ib-controller

You can download the latest version from

https://github.com/ib-controller/ib-controller/releases/latest

(quote-1)

One possibility is to use IBController, which is a Java program that loads

TWS and intercepts various window events and handles them automatically.

Note that IBController can only handle logon if you have opted out of the

security device scheme.

You can find IBController in the Files section of this forum, under Auto

Login Codes.

Richard

(end of quote-1)

(quote-2)

IBController is a Java application that was written to enable Interactive

Brokers Trader Workstation (TWS) to be run in "hands-free" mode. This

makes writing unattended automated trading systems possible. IBController

automates the TWS login by filling the login dialog with your login

credentials. It also handles the dialog boxes that TWS presents

during programmatic trading activies.

(end of quote-2)

link: http://sourceforge.net/projects/ibcontroller/files/

few random notes from IBController users:

—————————————————————————————————————————————-

by Mike Smith mikesmithv@gmail.com

You might try changing the MaxPerSize parameter to something larger, like from 128M to 255M. When that number is too small it can cause any number of weird symptoms. When there is not enough space to load a new class then a previously loaded class is unloaded and strange things can happen. Programmers sometimes assume static class variable are "global variables" that remain as long as the application is launched and that's not the case if the class is unloaded.

Not long ago TWS used the default MaxPerSize and that was not enough if launching under IBController. Adding -XX:MaxPermSize=128M the the IBController launch command was needed because of the extra classes loaded by IBController. Now I see on IB's web site the launch command for TWS now contains XX:MaxPermSize=128M just for a normal TWS launch. So it appears they have added more classes to TWS so they had to bump up that number for a standard launch. So it makes sense a larger number is needed for launching with IBController now.

I don't use IBController anymore so all this is based on my past experiences with it. Now I use the gateway restarting it once a week and just let it run all week on one log in. So all this "in theory" and not my direct experience. I hope it makes sense.

see also discussion:

Optimal memory setting

https://groups.io/g/twsapi/topic/4047139

—————————————————————————————————————————————-

[Q] How to set up IBController (3.2.0) + TWS (build 956) on headless Ubuntu 16.04 LTS to run TWO accounts (paper + real) in 10 minutes?

[A] https://dimon.ca/how-to-setup-ibcontroller-and-tws-on-headless-ubuntu-to-run-two-accounts/

Added on 13-Jun-2016

Note: First, please note IBController is now effectively superseded by IBC. You can read about the reasons for this change here. You should probably consider switching to IBC.

[Q] How to setup IBC in docker

[A] by dvasdekis <notifications@github.com> view it on GitHub

Added on 19-Jul-2020

I maintain an updated docker container with IB Gateway v978.2c and IBC v3.8.2 here. Feel free to link to it instead of maintaining an independent solution.

[Q] Where do we get the latest versions of TWS API?

[A] http://interactivebrokers.github.io/

[Q] How to reset TWS connections?

[A]

Ctrl-Alt-R resets the account server connection

Ctrl-Alt-F resets the market data connections

[Q] which version of TWS should I use?

[A] by Ruediger Meier sweet_f_a@gmx.de

Actually I install all TWS versions in parallel just to be able to try

it out whenever I will be in the right mood.

The default one which I also use for production is the stable version

936.9l.

For those who don't know it, IB provides stable and latest versions. The

current stable TWS gets only bugfix updates but no new features. That's

why it has such a high minor version number (letter).

[Q] How to reset a paper account?

[A1] View/Reply Online (#46218)

Added on 25-Jan-2021

|

This, from IB, worked:

You can reset your paper account equity to a value different than the original and up to five times your production account value. Please note that reset requests should be entered before 16:00 EST in order to take effect for the next business day.

Please follow below steps to reset paper equity balance:

1. Log into your paper trading Client Portal by clicking the toggle on the login screen 2. Select Settings followed by Account Settings 3. Click the Configure (gear) icon next to Paper Trading Account Reset 4. Select the reset amount from the drop down menu provided and click Continue. |

[A2 (oder – from around "before 2017")] by Eric J. Holtman

Under "Trading Access", pick "Paper Trading Account Reset".

— or —

Log into paper account management (don't log into regular account)

https://www.interactivebrokers.com/sso/Login

Left side of screen – "Trading Access" – under that – "Paper Trading

Account Reset"

It doesn't kick in until next trading day.

by Jim Covington

[Q] How API version maps to client/server version I see in a log?

[A] by IB support (by phone)

Client side:

API 9.67 —> Client version 59 TwsApiC++.9.67_3.zip

API 9.70 Release Date: October 2013 —> Client version 62

API 9.71 Release Date: Aug 6 2014 —> Client version 63

Server side:

build 946 —maps-to—> TWS socket server version 71

[Q] Client can not re-connect to TWS using the same client ID after connection was not properly closed.

[A] by Dmitry

https://groups.io/g/twsapi/topic/4047690

And followed discussion in the hijacked thread 😉

Same topic was also discussed here:

https://groups.io/g/twsapi/message/37644

Basically it is about: when client closes connection to TWS abruptly then client often can not reconnect using same client id. One would need to restart TWS or wait for things to self-release on TWS app side (up to about 1 hour).

[Q] How to change ib primary HOST? (moving to new region)

|

Just got a box in NY4 but my IB account still connects to ASIA – hdc1.ibllc.com even though I choose region as – America at login window… Any config I can change to force IB connects to USA East – ndc1.ibllc.com? |

[A] by Evgeni Andreyev e.andreyev07@gmail.com View/Reply Online (#45559)

Added on 03-Oct-2020

|

No, you have to explicitly request (from IB Support) moving the IB server assigned to your account at registration to a new location. This will then happen over the weekend. |

[Q] TWS SLOW connection times?

[A] by JR <TwsApiOnGroupsIo@reinold.org> View/Reply Online (#46681)

Added on 03-Mar-2021

|

Since the tally of folks that have the same issue seems to be approximately zero, IB having an issue feels unlikely, though not impossible. So let me briefly raise three things that I'd look at if I'd have to troubleshoot API connection issues.

[1] Stale API connections: We once wrote a simple "Is my TWS alive and actually connected to IB" monitor that would connect to TWS, do a simple operation that requires TWS to communicate with IB, and then disconnect. The monitor was started automatically and frequently but somehow caused stale (not completely closed) API connections to build up. When you click "DATA" to get the connections listing in TWS, do you see stale API connections from past script executions? Those did cause connection request delays, in my case, even when TWS was far away from the maximum number of API connections.

[2] DNS reverse lookup: You said you checked the network on your server, but did you check DNS as well?

Several library functions unexpectedly perform "reverse DNS lookups" and can block the caller (in this case the thread in the Java JVM that handles your incoming API request to TWS) for extended periods of time until failing DNS lookups succeed or time out. If your internet service provider has any instability with reverse DNS lookups, otherwise perfectly fine servers can have operations seemingly randomly freeze for 20 to 30 seconds.

[3] How are your entropy levels? This is a little stretch but fits the symptoms you are having if you are running some kind of Linux system. And it took me weeks to figure that out on a server I had in a data center in Dallas (though this is not specific to Dallas or Texas)

In order for strong SSL encryption to work, the Linux kernel collects "truly random events" and builds up a buffer of entropy that Java JVMs (and other programs such as sshd, httpd, …) access through the /dev/urandom device. And while only very few bytes are needed each time, opening or reading from /dev/urandom when the buffer is low or empty will block the caller until enough entropy has been collected. And the Java JVM frequently opens /dev/urandom when various network related operations take place.

You can read up on this with "man urandom" and check your server's entropy level with "cat /proc/sys/kernel/random/entropy_avail"

Hope this helps. |

Code Examples for beginners

[Q] I'm a total noob, where to begin?

[A] by ExStock View/Reply Online (#45602)

Added on 10-Oct-2020

|

I also started from scratch, so I don't mean to discourage you, because it can be done! But there is a lot that you'll probably need to learn in order to do what you want safely. (Be sure to spend a lot of time working with an IB paper trading account before trying anything out for real!)

One place you might want to start are the videos about the Python TWS API available from IB: https://tradersacademy.online/category/trading-courses/ibkr-api . These videos are a bit like drinking from a firehose–lots of information very fast–but they do cover a lot of the basics, and you can just hit pause a lot.

With those videos as background knowledge (and they do show the actual Python code involved for each example) you might want to consider installing the ib_insync Python framework, which simplifies the process: https://ib-insync.readthedocs.io/index.html . If you click on the Notebooks link, you can see more code examples.

You might also want to install either Jupyter Notebook or JupyterLab (you don't need both): https://jupyter.org/ . They both make coding in Python simpler, as well, and will make what you see in the ib_insync notebooks easier to follow and experiment with.

Finally, if you do get into ib_insync, there's also a groups.io for them: https://groups.io/g/insync .

All of the above is free to play around with–good luck! |

[Q] Is there a book you may recommend for a newbie like me, to really know what I am doing, what I should look for doing and what I should carefully understand and avoid?

[A] View/Reply Online (#45571)

Added on 06-Oct-2020

Algorithmic Trading with Interactive Brokers by Matthew Scarpino has some basic python scripts and a few list of parameters that is useful for a beginner.

That book is good, I'd also recommend looking at Rob Carver's blog (https://qoppac.blogspot.com/) he's got a section (March 2017) on how to use the IB API, it covers the basic stuff connecting, getting prices, trading, reconciling which you can then build on.

[Q] Where can I find C++ and C# tutorials/examples using ActiveX?

[A] by Rich Holowczak (a.k.a. “Prof. H.”) (src)

Folks

A while back a wrote a series of tutorials for the Interactive Brokers API for my Financial IT classes. I am now getting around to assembling them on my web site. I have a few going up now using Visual C++ and Windows Forms. I will be posting more over the next few weeks that include WinForms with C# as well. Your comments and suggestions are welcome:

http://holowczak.com/category/ib/

Cheers,

Rich H.

[Q] Where can I find working posix C++ code examples?

Try to check “Files” section of TWSAPI Yahoo Group. Also:

[A1] by Jim Covington

Sample code is on your machine inside the IB API installation folder.

[Q] Where can I find MORE ADVANCED working posix C++ examples?

Try to check “Files” section of TWSAPI Yahoo Group. Also:

[A] There is a great IB API Wrapper TwsApiC++ by Jan Boonen (see on GitHub)

(quote)

In the C++ implementation, the basic two API classes are EWrapper and EClient, in combination with the other classes/structures defined in the directory 'Shared'. Comparing with Java, these classes are pure interfaces. The implementation of EClient is done in EClientSocketBaseImpl and at linking time, all is connected. The implementation of EWrapper is up to you.

Almost every C++ programmer opts to write the definition of a class and its implementation in two distinct files, although C++ does not enforce it. I prefer more the Java way, although C++ does not support it to the same extend. Some care is needed, and when pure interfaces are needed, the definition and implementation has to be separated anyway. So when studying different C++ projects, you will discover different approaches. Discussing all the pro's and contra's is a never ending story, as are the programming text style discussions.

The non-posix version of the api cannot be used as stand alone. It depends on the Windows specific socket implementations for reading the socket and calling the EWrapper methods. So the 'EReader' is somewhere down deep in the windows specific asynchronous socket stack.

This makes the non posix version non-portable and unusable for a non-windows program. To overcome these two weaknesses, some free libraries exist. I started the free TwsApiC++ library in 2008. The current version is based on the posix library of IB.

What does this TwsApiC++ library offers you:

a) the EClient and EWrapper are still the basic two API classes (or more specific, a derived version of it EClientL0 and EWrapperL0). So no need to access all the internal classes such as EClientSocketBase, or the other complex posix classes.

b) it implements an EReader, which is turned on by default. It runs in a separate thread, and waits for the incoming data on the socket, and calls the EWrapper methods without any delay. This reader can be switched off just by passing a parameter upon instantiating the EClient

c) it implements an empty method for every EWrapper method defined. So you only have to implement the one you are interested in

d) It protects the inner working of the IB library, where the TwsApiC++ is a wrapper around, from the possible exceptions thrown in the users code, but not catched by it.

e) It protects the EClientSocketBaseImpl from concurrent use of its internal members, which could lead to loss of requests send to the TWS

f) It ensures the data stuck in the buffer of EClientSocketBaseImpl and failed to be send to TWS for some reason, is send as soon as possible, and not sits there waiting until the next EClient call is made. In the posix api, you the programmer has to take care of that(!)

g) optionally, it provides a way to check the correct spelling of the many textual or numeric parameters upon compile time instead of runtime.

The library is small and fast. A few examples/test programs are included, and also project files for Visual Studio and make files for linux/unix are included

It includes a readme file.

See it on GitHub:

https://github.com/JanBoonen/TwsApiCpp

Or for group members:

See Files > C++ Code > TwsApiC++ Directory

There are other implementations too, other members of this group know more about these.

Have fun with it.

Jan

(end of quote)

see also tutorial how to install TwsApiC++ here: [Q] Installing IB Gateway and TWS API for linux? (tutorial by Rich Holowczak (a.k.a. “Prof. H.”))

Note from Kurt:

when I *was* using TwsApiC++ I had to do extra work to *undo* the fact

that (like Java, I guess) TwsApiC++ creates a separate thread to read the

socket, and callback messages come in on that "reader thread". So I needed

another layer of buffering to get the callbacks to come in on the main

thread, and this required a tricky set of function overloads which pretty

much required modifying the TwsApiC++ implementation classes due to how

things were (not) factored.

The posix TWSAPI either does not require any such effort. Either there is

not a separate reader thread, or the buffering is already taken care of. (I

can't remember which.)

-Kurt

Another note from Jan came from here

JanB

Message 16 of 28 , Oct 20, 2010

View Source

Hi all,

I second this: the new improved API shouldn't reinvent the wheel, but rather make the current IB API a 'more round wheel and easier to turn' (hope this makes sense).

As Shane Cusson states, implementing a simple strategy with IB's API is 'like using a bazooka to swat flies'. So this new API should simplify its use, but should not prevent the implementation of complex strategies either.

For the C++ implementation, something like TwsApiC++ is a first step as it hides the use of the sockets. Not ESocketClient is the interface, but EClient/EWrapper is. Having to deal with the sockets in your ATS is fundamentally wrong, isn't it? TwsApiC++ more or less levels the C++ API with something like the API from dinosaurtech for C#.

On top of that, I'm implemented/ing two extra layers and I thought it could be interesting to share them here:

In a first layer on top of EClient/EWrapper (EClientL0/EWrapperL0):

1) The functionality of EClient/EWrapper is regrouped in functional classes such as Connection, MktData, HistoricalData, PlaceOrder, Account, Portfolio, etc. Each class keeps the data needed to make the request, and all EWrapper events related to the request are routed back to the requesting class. I.e. each reqHistoricalData to be executed needs its own instance of the class HistoricalData, which handles the request and receives all the historicalData() events for only his request.

2) It hides all the Id's (tickerId, orderId, reqId ): the allocation of the id's is automated and hidden. Errors with id==-1 are routed to the Connection class.

3) The classes for Account and Portfolio filters the events on the acctCode, so each account can have its own instance of Account and Portfolio. A blank/empty acctCode makes it to receive the data for all the accounts in case of.

4) Each of these classes have a common interface of a Request(), Cancel(), Resend() and Error(). The parameters for the req… are set during the allocation of the classes, so the Request() method has no parameters.

As the first layer resembles the EWrapper interface and does not adapt to any special behaviour of the IB API, the second layer goes one step further to make live easier for the programmer as follows:

1) it stores the data for classes such as Account, Portfolio, HistoricalData etc. (not for Mktdata or RealTimeData i.e. )

2) offers a more uniform interface when possible: OnInit() (called after the …End() events meaning all Account is available, Historicaldata is complete etc), OnChange()(i.e. after the Init() was called, and new updated Account data receives), and a ForEach(), forward and backward Iterators, etc. to access this data.

3) Split up of the MktData into MktDataSTK, MktDataFUT etc. The work-around for the "zero size bug" of Mike Smith does fit in this layer nicely.

4) a connection persistence and Resends the requests in case the link was broken with error (1101), 1102, 1300

5) A run method in the Connection class: i.e. Run(Run::Until(15,30,00)); which basically loops and calls checkMessages() and Connection::RunActions(). So my ATS or test programs have all a very compact 'main' routine: allocate the ATS and a call to the Run method.

I hope this view, although implemented in C++, is of any help. The implementation is not complete yet.

Jan Boonen

[Q] Python?

[A] For IB API + python awesomeness please check out:

Free udemy course: "Python programming with Interactive Brokers' Trader Workstation API"

https://www.udemy.com/course/python-api-for-trading/

Also:

|

For the Python language, Ewald de Wit has created an amazing framework called ib_insync that takes care of all the housekeeping and management functions and let’s you focus on your client code and trading. In case you are not aware of it, take a look at his GitHub repository and the extensive documentation. ib_insync allows you to operate the TWS API in its natural asynchronous request/response mode but also provides convenient blocking versions for more traditional sequential approaches. You can also use it as a rich source of examples on how you can achieve synchronization in Python. Just take these two lines of code as an example. This is all you need in ib_insync to connect your client to the TWS API ib = IB() ib.connect('127.0.0.1', 7497, clientId=1) Compare that with your code where you had to spend about 75% with boiler plate and connection related activities. The ib_insync package: https://github.com/erdewit/ib_insync and related discussion group: |

Also: sprach groupse.io forum by word “jupyter”

https://groups.io/g/twsapi/search?q=jupyter

And then also:

https://groups.io/g/twsapi/message/37515

Use a GUI library like tkinter or pygame. For testing you could also use jupyter, there's a sample in here somewhere.

https://groups.io/g/twsapi/message/37329

https://groups.io/g/twsapi/message/37341

[Q] Delphi?

Try to check “Files” section of TWSAPI Yahoo Group. Also:

[A] by josejp1

In this link are good examples of programming of Trader Workstation API with Delphi

http://delphimagic.blogspot.com/2010/07/interactive-brokers-con-delphi-tws.html

Ej. Connect with TWS, request market data, get ticks of price, place an order (mkt, lmt, stp, etc), request historical data, get information of an order, how to cancel orders

— also —

Delphi / BCB / Kylix TIABSocket component & API

http://www.hhssoftware.com/iabsocketapi/index.html

updated to the latest 9.76 API (January 2020)

This component set is built to work with the Interactive Brokers TradeWorkStation API. It allows Delphi and BCB programmers to build apps that send orders directly to the TWS. This TIABSocket component links directly to the socket to communicate with the TWS. There are no dll, ActiveX, .Net or DDE files required, and all socket messages & data processes instantly. This direct connection to the socket makes for a fast reliable interaction and response time. The component set also controls all interactions with the TWS, and includes sub components to manage order activity, portfolio and account details. The code looks and feels like any other Delphi component, and the syntax is similiar to existing standard component code. The complete source is included, along with a demo app and help file.

[Q] Java?

Try to check “Files” section of TWSAPI Yahoo Group. Also:

[A] by Suminda

I have started a CEP (Complex Event Processing) based trading system which will be agile as possible. This is at a conceptualisation stage where we are running a few experiments on how the final architecture will be. Is it possible to help out in this as well as help build the team to take this forward.

Suminda

http://code.google.com/p/cep-trader/

java sidenote: by hubert.tse@gmail.com

My Eclipse was set on Java Compiler -> 1.5 Compliance Level.

Apparently 1.5 does NOT support @override and thus will not run. Once you set this to 1.6 and beyond, all the errors go away and it launches perfectly.

Many thanks for all your help!

—

[A] by Rob Terpilowsky (thread)

The 2 libraries I've used are

ta4j: https://github.com/mdeverdelhan/ta4j

and TA-Lib :http://www.ta-lib.org/

I prefer ta4j as it has a cleaner API than TA-Lib.

The 2 libraries I've used are

ta4j: https://github.com/mdeverdelhan/ta4j

and TA-Lib :http://www.ta-lib.org/

I prefer ta4j as it has a cleaner API than TA-Lib.

[Q] ruby?

Try to check “Files” section of TWSAPI Yahoo Group. Also:

[A] by Dr. Hartmut Bischoff

Well, there is ib-ruby, too.

You can use pure ruby scripts, like

require 'ib'

ib = IB::Connection.new :port => 7496

ib.subscribe(:Alert, :AccountValue) { |msg| puts msg.to_human }

ib.send_message :RequestAccountData

ib.wait_for :AccountDownloadEnd

ib.subscribe(:OpenOrder) { |msg| puts "Placed: #{msg.order}!" }

ib.subscribe(:ExecutionData) { |msg| puts "Filled: #{msg.execution}!" }

contract = IB::Contract.new :symbol => 'WFC', :exchange => 'NYSE',

:currency => 'USD', :sec_type => :stock

buy_order = IB::Order.new :total_quantity => 100, :limit_price => 21.00,

:action => :buy, :order_type => :limit

ib.place_order buy_order, contract

ib.wait_for :ExecutionData

https://github.com/ib-ruby/ib-ruby

—

Dr. Hartmut Bischoff

Stuttgart

Update 06-Jun-2018: by Dr. Hartmut Bischoff:

(quote)

Imagine you got a trading robot at a remote location, accessible only via an reverse ssh tunnel, or a TWS is running on a cheap cloud-server.

Simple-Monitor ( https://github.com/ib-ruby/simple-monitor ) is designed to display the status of a Friends&Family-Account via web-interface.

It comes with just 435 lines of code using the camping micro-framework and ib-ruby.

Its intended to run even on resource-low hardware and serves well running elinks in a tmux-session, avoiding a running TWS-GUI in favor of the TWS-Gateway

It too demonstrates how well ib-ruby ( https://github.com/ib-ruby/ib-ruby ) integrates in existing frameworks.

(end of quote)

[A2] by Peter Gum

IBCsharp, tradecommander, openquant,

tradelink and others. RighEdge <http://www.rightedgesystems.com/> is as

comprehensive as any, including supporting VB.NET

google "jTWScharts"

[Q] C#?

Try to check “Files” section of TWSAPI Yahoo Group. Also:

[A1]

see: Interactive Brokers C# Api (by Karl Schulze)

ib-csharp

https://github.com/krs43/ib-csharp

and/or:

http://www.dinosaurtech.com/utilities/

[A2] by Rich Holowczak (a.k.a. “Prof. H.”)

I have written a few more to work with IB's C# API (console only applications). same location:

http://holowczak.com/category/ib/

Cheers

Rich H.

if you aware of any other published working code examples, please let me know so I can add the link into this FAQ

[Q] R

[A] by ce (from this thread)

pdf files in

http://cran.r-project.org/web/packages/IBrokers/index.html

are good.

Also there is a very good example system in

[A2] by censixtws (from this thread)